Reinsurance

Winds of Change

Losses from Typhoon Jebi caught reinsurers by surprise, resulting in increases in loss reserves and suppressed cat bond returns while laying the groundwork for higher rates.

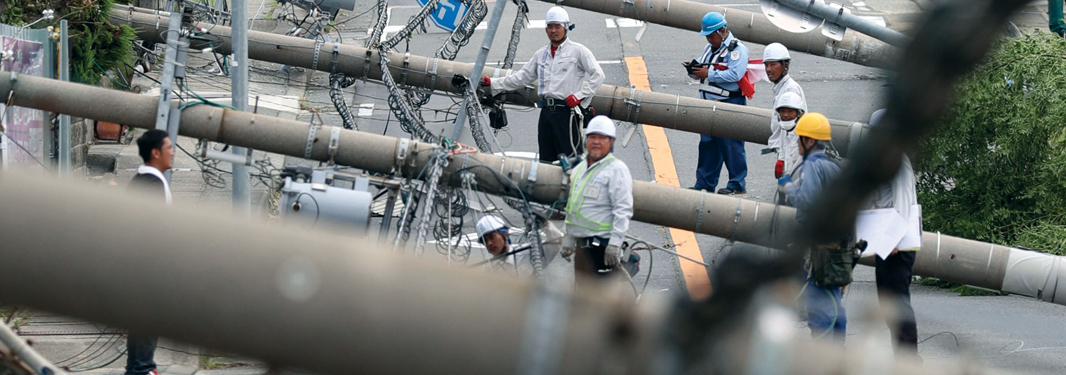

STORM AFTERMATH: Utility poles litter a road in Sennan, Osaka prefecture in Japan after Typhoon Jebi hit in September 2018. Insured losses could rise to $16 billion.

Photo Credit: AP Images\Kyodo

Key Points

- Rising Waters: Unexpected claims from Typhoon Jebi resulted in one of the industry’s most significant loss creeps.

- Making Landfall: Cat bonds, collateralized reinsurance vehicles and ILS funds were impacted by the historic storm.

- A Flood of Changes: Experts anticipate a continued rise in reinsurance rates and a possible hardening of the market.

The Reinsurance Special Section is sponsored by Munich Re. Click on the microphone icon to listen to the Munich Re podcast or go to www.ambest.com/ambradio.

The warnings blew in like fierce winds. Japan was in the direct path of what forecasters feared was quickly forming into one of the planet's most powerful storms.

When the Category 5 storm made landfall in western Japan on Sept. 4, 2018, it became the strongest typhoon to hit the country in 25 years. As the storm approached land, sustained winds—clocked at more than 170 miles per hour at one point—slowed to around 85 mph.

But tide levels surged to a record high and destruction spread across Japan's south-central Kansai region.

Mother Nature's powerful force collapsed buildings, toppled power lines and overturned trucks. Violent winds also untethered a 2,591-ton tanker from its anchorage, sending it crashing repeatedly into the Kansai International Airport Bridge and forcing the shutdown of the major international airport.

Initial insured loss estimates from the deadly storm hovered around $5 billion.

But in the months to follow, those estimates climbed. By May, industrywide Jebi-related losses were pegged at $12 billion and rising.

Even today claims continue to roll in, and analysts project the final loss tally could eventually settle at nearly $16 billion to create one of the largest loss creeps the industry has ever seen, said Steve Evans, owner of Artemis.

A Rising Tide

Higher average claims costs and business interruption exposures largely caused the rising tide of losses.

“What was missed by our ceding company, not only by the reinsurance community, was the business interruption and contingent BI loss exposures that were inherent in exactly the location where Jebi hit, and a lot of it had to do with semiconductors,” Arch Capital Group CEO Marc Grandisson said in a 2019 first-quarter earnings call.

Those exposures, he said, were not properly reflected by the models. “It was not fully appreciated by most people, by the whole market, frankly,” Grandisson said.

Also, rising repair costs and a limited supply of surveyors in the nation from ongoing construction activity for the 2020 Olympic Games in Tokyo contributed to the loss creep.

Catastrophe models, which initially projected Jebi losses at around $3 billion, focused on property exposures.

However, the models' initial loss estimates failed to take into account business interruption losses, marine hull and cargo exposures and potential higher repair costs caused by other recent natural disasters, said Josh Darr, a meteorologist and a senior vice president at Guy Carpenter.

In the weeks just before Jebi hit, Japan had been besieged by deadly flooding, landslides and heat waves. A 6.1 earthquake shook the nation's northern Osaka prefecture in June.

Just weeks after Jebi moved across Japan, the country's western region was hit by Typhoon Trami, a Category 2 storm at the time of landfall.

The combination of these various events took a toll on insurers and reinsurers.

Early this June, Jebi's claims-paid total had reached nearly 1.1 trillion yen, equivalent to about US$9.9 billion, according to the General Insurance Association of Japan (GIAJ).That number comes on the back of more than 857,200 claims payments made, the majority of which were for property fire insurance policies, according to the GIAJ.

Typhoons Jebi and Trami drove some relatively steep price hikes in this year’s April 1 renewals, particularly in excess-of-loss covers for Japanese wind exposures.

Christie Lee

AM Best

While insurers had to dig deep into their pockets to cover those and other Jebi- and Trami-related losses, reinsurers were ultimately left footing much of the bill.

Many were forced to increase loss reserves in last year's fourth quarter and the 2019 first quarter from Jebi, now the most costly typhoon to ever hit Japan, Evans said.

Arch Capital Group's first quarter results included an increase in reserves of $16 million.

Swiss Re and Sirius International Insurance Group increased reserves for the storm in the final quarter of 2018. Munich Re saw a nearly 60% climb in initial reserve estimates for Jebi.

Those losses have been the catalyst for some rate increases.

Typhoons Jebi and Trami drove some relatively steep price hikes in this year's April 1 renewals, particularly in excess-of-loss covers for Japanese wind exposures, said Christie Lee, senior director, analytics, at AM Best Asia-Pacific Ltd.

Industry experts said Japanese reinsurance rates increased up to 25% on loss-affected property catastrophe layers at this year's reinsurance renewals. Layers unaffected by catastrophes saw renewal rate changes ranging from flat to more than 5%.

Several insurers' lower wind/flood catastrophe covers were exhausted by last year's storms.

“That's fairly unusual given that earthquake is typically the peril in Japan that erodes reinsurance rather than wind and water,” Evans said.

After Trami's strike on Japan's Wakayama prefecture last September, some insurers purchased back-up cover to recover the excess-of-loss layer to reinforce their lower-layer protection and cover additional losses from potential events such as snowstorms, according to AM Best's Japan Non-Life Insurers Focus on Profitability report.

Lee, a co-author of the report, believes that contributed to a reinsurance rate hike in the April 1 renewal season and that hike might continue further on loss-impacted layers in the near future.

“Because last year was a major eventful year in Japan and lower layers were hit, if reinsurance layers are hit with loss impact, reinsurers would expect a payback or increase in reinsurance rates at the next renewal,” she said.

Despite a year laden with high-dollar catastrophe losses, the global reinsurance market remains well capitalized at nearly $585 billion, said Steve Bowen, meteorologist and head of catastrophe insight at Aon.

The Japanese market is one of the largest buyers of catastrophe capacity outside of the United States, according to Willis Re's 1st View: Rational Markets report.

Direct Hit

Jebi created a flood of challenges for traditional reinsurers and the alternative capital market.

Not only did the storm place pressure on insurance-linked securities fund managers, but Jebi's rising loss toll also impacted other collateralized reinsurance vehicles and suppressed the returns of catastrophe bonds and reinsurance-linked investment funds.

One cat bond was tagged for potential loss due to rising Jebi-related reinsurance claims.

Mitsui Sumitomo Insurance's Akibare Re Ltd. (Series 2016-1) cat bond is “destined for a total loss” after exceeding its exhaustion point, said Emmanuel Modu, managing director, analytics, at AM Best.

The $200 million cat bond, the first in the industry to provide protection against typhoon events in Japan on an annual aggregate basis, provides Mitsui Sumitomo with a source of collateralized annual aggregate reinsurance backed by the capital markets and covers certain losses including some flood and wind risks, Artemis' Evans said.

Jebi is expected to trigger payouts of certain industry loss warranty contracts, “and payouts could eventually top $100 million.”

Steve Evans

Artemis

Jebi-related loss creep also created a lack of supply in the global retrocession market.

“It remains to be seen how that will play out and whether it will drive any further hardening of renewals rates later this year,” Evans said.

He expects growing Jebi losses could also trigger payouts of certain industry loss warranty contracts.

“If final loss estimates reach the $15 billion to $16 billion mark then some ILWs could be exposed at that level, and payouts could eventually top $100 million,” he said.

Despite challenges in the market, “the good news is that Jebi losses were spread among participants across the marketplace so no single player was significantly impacted,” said Guy Carpenter's Darr.

“Also, Japan's ILS market remains relatively underweight so the impact wasn't as significant as other events such as Hurricane Irma. But that being said, the loss deterioration associated with Jebi has affected some collateralized reinsurance and retrocessional vehicles,” he added.

Over the last two years, insured natural catastrophe losses have aggregated to more than $240 billion, according to a report from Aon. The broker noted that while traditional reinsurers have managed to trade through the events without capital impairment, the impact has been more significant for alternative capital. “This time the ILS market took a particularly big hit, but next time it could be traditional reinsurers,” Evans said.

Despite the recent slew of loss-producing natural disasters in Japan and across the globe, alternative reinsurance capital grew 9% last year, according to Aon.

Stem the Tide

Industry experts fear events like Jebi and Trami could become the new normal in Japan and globally.

Already this year, the Pacific basin was hit by Typhoon Wutip, a Category 5 storm that has entered the history books as the most powerful February typhoon on record, surpassing Typhoon Higos in 2015.

“Events like those reiterate the need for the reinsurance products that companies need to protect against peak peril risks,” Artemis' Evans said.

Rising typhoon activity is also expected to awaken interest in modeling Japanese typhoon risk to help companies better understand their occurrence and aggregate loss potential, said Milan Simic, executive vice president at data analytics and risk assessment firm Verisk.

Models like AIR's basinwide models allow global insurers and reinsurers to assess typhoon risk to portfolios and policies that span multiple countries while also allowing local direct insurers to analyze region-specific risk, he said.

The models capture the effects of tropical storm and typhoon winds, storm surge and precipitation-induced flooding on insured properties.

“Insurers and reinsurers use AIR's catastrophe risk models to find the probability of occurrence of the similar aggregate loss (occurrence of two consecutive years), but they do not have a predictive component,” Simic said.

Going forward, Artemis' Evans expects companies to begin securing even more cat bond coverage for typhoon risk.

“And given the concentration of catastrophes in the retrocession market, it will also be interesting to see if any of the big global insurers will look at cat bonds or other ILS solutions as a way to secure more reinsurance for Japan as well,” he said.

Despite recent events, Japan remains a profitable market for both insurers and reinsurers, said Jean-Paul Conoscente, CEO of Scor Global P&C.

“The Japanese client mentality is to build long-term partnerships and to provide payback over time when large cat events occur. We've seen this after 2011 events and we expect this to continue following last year's events,” he said.

Also likely to continue are premium rate increases by Japanese nonlife insurers looking to increase the expected profitability for the fire line, which will help offset higher reinsurance costs after last year's catastrophe-related losses, said Jason Shum, associate director, analytics, at AM Best Asia-Pacific Ltd.

Earlier this summer, MS&AD Insurance Group Holdings said it expects to raise rates by around 7%. Tokio Marine Holdings reported its domestic nonlife unit will increase fire insurance rates, which will generate 15 billion yen in profitability improvement. Due to the long-term nature of the fire policy segment in Japan, 10%, 50% and 80% of the benefit will materialize during the current fiscal year, 2020 and 2023, respectively, Shum said.

The impact on profitability from rising reinsurance costs will be partially offset by the rate hikes, he said.

“For the 2019 fiscal year ended March 31, 2020, some insurers might have to reduce dividends and improve their underwriting profitability to restore their catastrophe loss reserve balance,” Shum added. However, barring any further loss developments from last year's catastrophes, he doesn't expect insurers' balance sheets strength to suffer any additional impacts this year.

Storm Warning

One of the biggest lessons to come from Typhoon Jebi is the possibility of multiple cat events impacting an area in a single year, said Christie Lee, senior director, analytics, at AM Best Asia-Pacific Ltd.

“What that signals to insurers is the need for sufficient coverage in aggregate insurance. So whether they are protecting the capital or surplus really depends on the adequacy of the aggregate coverage,” she said.

Last year some areas of Japan were reeling from four separate events that struck within a matter of weeks. “That created a challenge for the industry to assess what damage was caused by which event and allocate losses to individual events,” Steve Bowen, meteorologist and head of catastrophe insight at Aon, said.

Also challenging for the industry was the significant number of wind and flood claims to come from typhoons Jebi and Trami.

“Typically tropical cyclones lose some of their tropical characteristics by the time they make landfall in Japan given the higher latitude, but last year's storms maintained their tropical state and produced widespread wind and water-driven damage,” Bowen said.

Flood-related losses were covered by cat bonds, said Steve Evans, owner of Artemis.

“One of the things I hope Japanese insurers learned from Jebi is that now, for the first time, typhoon cat bonds in the country also cover their losses for related flood risks,” he said.

He added that ILS contracts also now include more coverage for elements like business interruption.

“Now that claims have come in and things are starting to settle down, one of the things that will be interesting to see going forward is how communities hard-hit by Jebi will rebuild and whether building code standards will be upgraded to make structures more modern and resilient to higher wind speeds,” Aon's Bowen said.

He said the industry will continue to keep a close watch on what mitigation steps will be taken to ensure that future catastrophes from a residential and commercial perspective are protected.