What AM Best Says

US Property/Casualty Financial Results Improve

Best’s Market Segment Report (Excerpt): 2019 Review & Preview: US Property/Casualty (Feb. 26, 2019)

AM Best is maintaining its Stable outlook for the U.S. property/casualty insurance segment. The industry posted better results in 2018, with lower catastrophe losses and continued increases in premium expected to result in a lower combined ratio than in 2017. However, the rate environment in most commercial lines remains challenging and underlying loss experience deteriorated, reflected in the increase in the normalized accident year combined ratio. Loss reserve development is expected to remain favorable, but with an overall decline in the benefit of prior accident year adjustments in 2018.

P/C insurers are affected by both macro level trends and factors that impact specific segments or lines of business. The market segment outlooks included at the end of this report provide AM Best's perspective on the near-term performance for various key P/C lines of business. Before getting to those specifics, we first consider the broader issues that continued to drive the industry's performance in 2018 and that will remain front and center in 2019.

U.S. catastrophe losses reached a near-record high in 2017, mainly stemming from hurricanes Harvey, Irma and Maria. For much of 2018, it appeared as though losses from catastrophic events would return to a more historically normal level. However, Hurricane Michael and historic wildfires in California during the fourth quarter drove a second year of catastrophic losses above the long-term average. AM Best estimates that the U.S. P/C industry had net catastrophe losses of over $37 billion in 2018—down from $53 billion in the prior year, but still the second highest since 2011.

Projections for 2019 reflect a further decline in net catastrophe losses to five points (or approximately $31 billion), which is more in line with an average year. AM Best expects pricing for loss-impacted accounts to be stronger in both the insurance and reinsurance segments, but loss-free accounts and those with limited catastrophe exposure may continue to see lower premiums. Continued declines in property pricing in the primary market may be driving some of the increase in the industry's normalized accident year loss ratio.

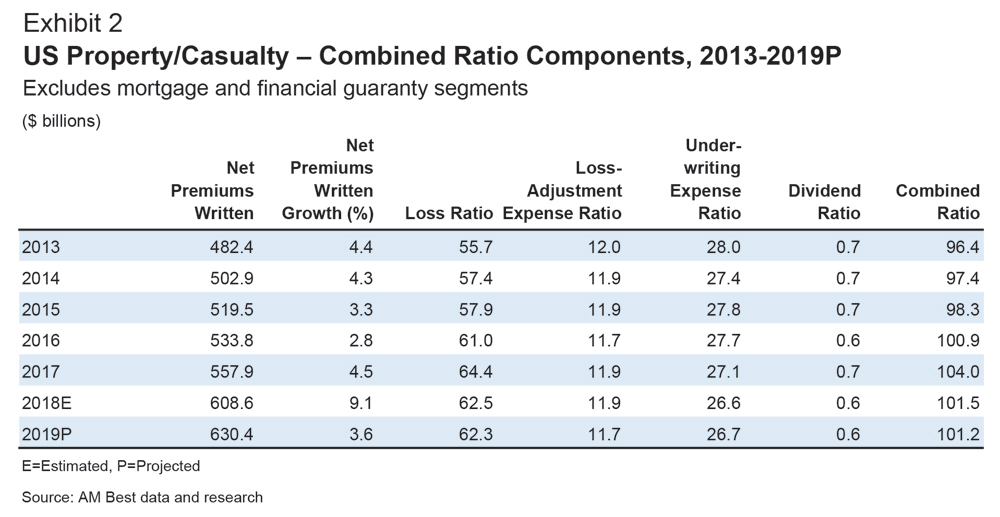

Net premiums written jumped in 2018, primarily as a result of U.S. tax reform enacted in December 2017. (Exhibit 2) Many companies that had previously ceded premium to offshore affiliates substantially changed those arrangements in 2018 to reduce or eliminate the effect of the Base Erosion and Anti-Abuse Tax (BEAT) that was included in the Tax Cuts and Jobs Act (TCJA). In some cases, premiums were simply retained in the primary companies, while in other cases, the premium was ceded to U.S.-domiciled reinsurers. The growth in the commercial and reinsurance segments has been particularly affected by these changes.

AM Best expects personal lines rate increases in 2019 to be higher than for commercial lines, reflecting increasing severity trends, even as companies continue to focus on expense efficiencies. In personal auto, rising medical expenses and costlier repairs of increasingly sophisticated vehicles are driving higher rates. We expect rate levels for the homeowners line to increase modestly across the board, with higher increases and some modification in coverage terms in the weather-impacted areas. Commercial lines are more of a mixed lot, with overall modest expectations for price increases in 2019. Commercial auto losses remain a drag on the industry's overall profitability, despite multiple years of substantial rate increases. As a result, further price increases are expected for the line in 2019. Other liability, which had seen a number of years of favorable experience, driven in large part by favorable development of prior years' loss reserves, has shown more variability in performance in recent years. Consequently, modest price increases also are expected for this line in 2019.

AM Best expects pricing in 2019 for other commercial lines to remain flat or decline modestly. Workers' compensation pricing has seen modest decreases overall in the most recent years, although much of the decline in rates has been offset by higher payrolls due to higher employment levels and some upward pressure on wages.

Uncertainty about macroeconomic issues may place downward pressure on exposure growth in commercial lines in 2019. Higher interest rates should provide some tail winds to the P/C industry, given its substantial reliance on net investment income to boost profits. However, turmoil in U.S. and global equity markets in the fourth quarter of 2018 is expected to drive down overall investment returns for the year. With the unemployment rate now lower than the historical level that denoted “full employment,” pressure on wages may spark higher inflation. The effects of the federal government shutdown on GDP constitute another “unknown” for 2019. Some economists project that there will be no GDP growth during the first quarter as a result.

The industry's prior years' loss reserves continue to develop favorably overall. With no unusually large reserving actions announced at year-end 2017 to adjust for, the long-term trend of diminishing favorable development is anticipated to continue in 2018 and 2019. Trends in the other liability line, where general liability has had increased variability, are being watched to understand whether a cyclical pattern is emerging, or if there has been a more fundamental shift in legal activity that will more permanently affect the future prospects of the line.

AM Best expects the P/C industry's pre-tax operating income to rebound to nearly $43 billion for 2018, driven by a lower underwriting loss and modestly higher net investment income. However, due to lower realized gains and unrealized losses on the industry's equity holdings, we anticipate a modest decline in equity of $3.6 billion to $768.1 billion, a drop of just 0.5%. We project a slight rebound for 2019, with a small decline in the underwriting loss and modestly higher net investment income. The 2019 forecast does not account for realized or unrealized capital gains or losses, which AM Best never projects when doing this annual study.

After a decade of year-over-year declines, we expect investment yield to show an increase for 2018, as companies are reinvesting proceeds from called and maturing bonds at the same or even slightly higher rates. Equity market declines in the fourth quarter of 2018 are expected to negatively affect the industry's holdings of common and preferred stock, with the overall level anticipated to decline for the first time since 2015. However, AM Best does not anticipate the P/C industry's overall investment mix to change substantially in 2019.

The industry's overall risk-adjusted capital position remains extremely solid, with the majority of P/C companies having capital levels that fall in the Strongest and Very Strong levels based on Best's Capital Adequacy Ratio (BCAR). Maintaining underwriting and pricing discipline in the face of these capital levels remains critical to the industry's continuing profitability. By developing and using increasingly sophisticated tools and leveraging data to better understand customers and their potential profitability, companies can retain an edge even under competitive conditions. In light of some uncertainty about near-term prospects for growth, inflation, and employment, those tools may be even more important in the years ahead.

The Best's Market Segment Report is available at www.ambest.com.