A Global Conversation

A Mixed Bag

Experts from the insurance industry discuss the emerging risks and growth areas that are impacting the multifaceted inland marine market with A.M.BestTV.

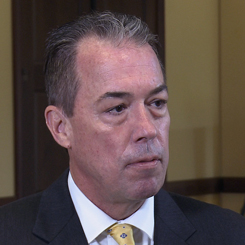

Kevin O’Brien

“There’s been a movement over the last few years where mass timber or cross-laminate timber is used in building wood construction. It’s greatly increased in terms of being able to elevate those structures from a five- or six-story structure to now, they can go 12-, 14-, and sometimes even close to 20.

The insurance market is still very apprehensive about mass timber. The mass timber process really refers to taking wood panels and gluing them together with an adhesive that makes it stronger. It also is able to then increase the height for the construction.

Another interesting emerging risk is the whole cannabis industry. Many U.S. states have made it legal for medicinal purposes. Also, several now have made it legal for recreational purposes. That industry is changing. There are exposures now that really weren’t contemplated before when it was contraband. You have transportation exposures going back to motor truck cargo. How are you going to ship these goods? You also have potentially warehouse legal liability where marijuana is being stored in warehouses and what can happen to that while it’s there.

The interesting thing though is it’s illegal in the U.S. federally and the federal government has pretty much said we’re not turning a deaf ear on this, and we’re not changing our position. There is no standard banking available for the marijuana industry. Primary insurers are backing away from it, because they can get into legal issues, and they’re not sure where the federal government is going to be on it. However, it remains a growing exposure that has to be covered by insurance.”

Kevin O’Brien

President & CEO

Inland Marine Underwriters Association

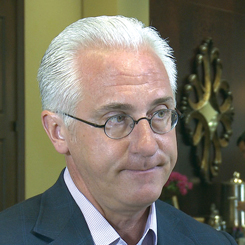

Rich Soja

“If you don’t have a few hundred million dollars to go buy a classic painting but you’d like to own a piece of it, there’s a website now where you can go buy .00275% of a classic work as an investment. You don’t get the property to take home. You don’t necessarily even know where it is, but you know you have a partial ownership of it.

As a collector, what do you do with that? How do you report that to your agent? How does it show up on your policy? If you go to that website, it says, ‘Fully insured.’ What does that mean? What happens if it’s not? Should our coverage form do something different than what it does today to address that growing trend? These are all the questions we’ll have to grapple with as this technology becomes more useful.”

Rich Soja

Global Head of Inland Marine

Allianz Global Corporate and Specialty

Robert Hartwig

“The inland marine market is one of the best performing of all major property/casualty lines. That’s been the case for the last 30 years. It’s been performing better in terms of underwriting results, with combined ratios that are typically in the high 80s, for instance, compared to, oftentimes, high 90s, or low 100s for the rest of the industry.

In terms of growth, it’s also seen growth that’s been above average in the post-crisis era. Whether we look at growth or we look at performance, we can see inland marine is one of the brighter spots in the commercial insurance space in particular.

Inland marine covers many different sorts of risks, including transportation-related and construction risks. As it turns out, the way that the economy is performing today is hitting the sweet spots of inland marine.

For instance, construction activity. Private construction investment is at an all-time high in the United States. That’s creating considerable demand and insurable exposures for construction equipment and so on.

When we’re talking about transportation and trucks, we’re seeing record numbers of miles and trucks being driven all across the country. This is good news for the inland marine business. It’s good news for the entire commercial insurance industry.

We’ve seen less softness in terms of rate in inland marine than we have in other areas. We just see much more disciplined underwriting here than is typically the case elsewhere in the commercial insurance space. Occasionally, inland marine gets hit by catastrophes big time, as does the rest of the industry.

But apart from those periods of time, it’s an outperformer.”

Robert Hartwig

Clinical Associate Professor, Finance Department

University of South Carolina

Richard Pye

“One of the classes of business that I’ve seen[new capacity] going, or one of the industry groups that I’ve seen it going to most frequently is wood frame builder’s risk business. I’ve seen projects up to $400 million being written in a couple of different ways.

One is nonadmitted through London with excess and surplus lines paper. Also, being put together with standard U.S. markets with quota share pieces of it with $10 million here, $20 million there, and being able to build up to those kind of numbers.

Wood frame projects in California and the Pacific Northwest are huge now. They’re very, very popular. It’s cheaper construction. It’s more earthquake resistant and being used more frequently.

We’re going to see it expanding across the country. You’ll see high rise projects, the podium construction where you’ll have noncombustible for the first couple of floors and then frame on top of that.

Primarily, it’s residential, it’s habitational. It’s condos and apartments going up that way.

I’m talking several stories up, like nine-, 10-, 12-story projects. It’s replacing steel. It’s much, much cheaper and lumber’s more available.”

Richard Pye

Chairman

Inland Marine Underwriters Association

Visit www.ambest.tv to watch the video interviews with these executives.