Trade Shows

The Grounded Visionary

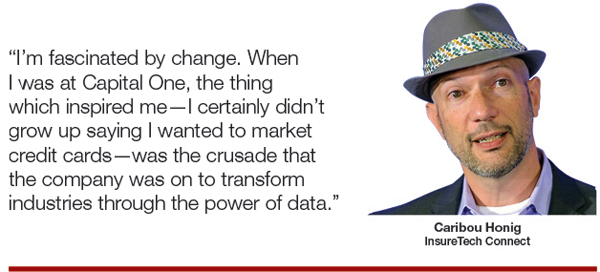

InsureTech Connect co-founder Caribou Honig took an unlikely path from credit cards to venture capital before finding a passion for insurtech--and event planning.

Key Points

Tough Ticket: The first InsureTech Connect in 2016 drew 1,500 attendees. The 2018 event is expected to draw more than 6,000.

Themes of 2018: The evolving dynamic between startups and legacy insurers, the blurring of the lines separating insurtech and fintech and the increased role for application programming interfaces are the industry’s top themes.

Crucial Time: The next 24 months will be a critical period for insurers as the industry transforms digitally and through talent recruitment.

The curious fellow prefers gray fedoras.

He appears as the top search result when you Google “stupid career decision.” (He wrote a first-person essay on the subject, and proudly considers his search engine status “one of my points of vanity.”)

Caribou Honig holds bachelor’s degrees in physics and philosophy from Harvard, a law degree from the University of Virginia and an MBA from its Darden School of Business. But somehow, his “journey from credit card executive to boutique venture capitalist” has led him to the world of insurance.

And to the “event planning” business.

“So if there’s any weddings or bar mitzvahs coming up, let me know,” joked Honig, a former Capital One executive and co-founder of QED Investors, a venture capital firm focused on data-driven technology companies such as Credit Karma, SoFi and Avant.

The event planning he refers to is organizing InsureTech Connect, a Las Vegas-based trade show that Honig co-founded three years ago with tech investor Jay Weintraub. It bills itself as the “world’s largest gathering of insurance leaders and innovators.”

InsureTech Connect has become a focal point on the insurance calendar among innovative-minded insurance executives. The 2018 edition will be held Oct. 2-3 at the MGM Grand Las Vegas.

It is one of the highlights that punctuate the second half of 2018, attracting a diverse and burgeoning collection of venture capitalists, consulting firms, data scientists, state regulators, entrepreneurs seeking financing, and of course, executives from AIG, Axa, State Farm and Travelers among others.

“It needed to be founded because one venture capitalist needed it to exist when he couldn’t find one,” said Honig, 47, the chairman of InsureTech Connect. “That’s where, being a little bit entrepreneurial and probably a lot bit foolish, I said, ‘Maybe I should create it?’

“We designed it for a focus group of one. Me.”

But that focus group is a profound one.

Honig’s presence in the venture capital world is so large, his departure last year from QED Investors merited a story in the Wall Street Journal.

“What’s unique about him is he’s a visionary, but still grounded in reality,” said Prashanth Gangu, a partner at Oliver Wyman, a management consulting firm. It sponsors the event. “In the insurtech space, people often are off in the clouds talking about blockchain and disconnected from reality. And then there are others who say the world isn’t going to change.

“Having someone who is a visionary to push a group of people forward but also have his feet firmly planted in reality helps him be effective.”

After a decade-long tenure with Capital One where he served as head of its underwriting, credit risk management and online marketing units, Honig delved into fintech.

But intriguing insurtech opportunities kept grabbing his attention, and soon he was focusing his vast intellectual curiosity on the space. He phased himself out of QED Investors to spend more time on it and other ventures.

Honig and Weintraub quickly discovered there were many others who shared his need for an insurtech event.

They anticipated no more than 1,000 attendees at the inaugural conference in 2016. More than 1,500 came. The number swelled to more than 3,500 last year, including attendees from nearly 50 countries and regulators from 23 states.

This year, they expect more than 6,000. About 250 speakers are planned and more than 50 sessions of panels and demos will be offered.

“It has quickly become an important event because it has catalyzed a bunch of pent-up energy and given a platform to showcase a lot of great ideas in an industry that is short on innovation and talent in some respects,” said Matt Leonard, a partner at Oliver Wyman. “And it has brought together a lot of people who were struggling to connect in the past.

“There is a lot of excitement and inspiration, and companies are starting to believe they can change themselves or find sorely needed capabilities and partners.”

One speaker at this year’s event might be Honig himself, who says he was named Caribou after the northern Maine town where he was conceived. It’s actually his middle name--Stephen is his first name--but he prefers Caribou.

“I grew up in upstate New York, so I’m lucky not to be named Schenectady,” he said.

He donned his fedora to block out the stage lights at the 2016 and 2017 events to deliver keynote addresses. The highlights of his speeches were widely reported in industry media.

The Richmond, Virginia-based Honig sees his mission as two-fold: “Read the tea leaves where the insurtech sector is headed and shine a spotlight on that” and introduce an unlikely cross-section of professionals to each other who normally would not meet.

The disparate groups at the event aim to disrupt the industry, find a niche--or in the case of legacy carriers--incubate or acquire data-driven innovation with the startup ethos and culture.

And mergers and acquisitions have only increased in the space.

The number of insurtech deals climbed 39% last year compared to 2016, according to CB Insights. The total value of the deals rose 32% to $2.3 billion.

The goal of insurtech is simple, Honig says: Drive change by reducing friction, lowering costs and increasing transparency.

“I’m fascinated by change,” he said. “When I was at Capital One, the thing which inspired me--I certainly didn’t grow up saying I wanted to market credit cards--was the crusade that the company was on to transform industries through the power of data. That is invigorating. It started with credit cards but moved on from there.

"I'm an optimist in my heart when it comes to the impact of technology as a net good for the human condition. I am enthralled with innovators."

And some in the industry seem enthralled with him.

“He’s a Renaissance man,” Leonard said. “He’s got a really thoughtful perspective on what it takes to change an industry and on what a sound business plan could look like. He’s quite ably applying some of the lessons learned from other sectors to what the possibilities are in insurance.”

The evolving dynamic between startups and established insurers will be one of the key themes as the calendar marches toward 2019, Honig says.

At last year’s event, he framed it as a great confrontation between the two sides. While he still views it that way, he now wonders if victory will be determined by collaboration or acquisition.

“One of the questions I like to ask is: Am I trying to be a part of your supply chain or am I trying to have you be a part of my supply chain?” Honig said. “The winner may be determined by who best assimilates, which may mean partnerships or acquisitions, the capabilities of the insurtechs.”

Other key themes will be a blurring of the lines separating insurtech and fintech and the increased role for application programming interfaces for both incumbents and startups.

“We’re at the beginning of a movement to API-ify the insurance stack,” Honig said of the set of instructions and standards that programmers can use to create software and interact with outside systems.

In fact, he’s so convinced of their emerging importance, he is creating a library of insurance-related APIs so they can be easily found and catalogued.

Honig views the next 24 months as a critical period for insurers as the industry transforms in the digital world and with the new breed of talent it is recruiting.

Organizations that are “serious have to look at it as a complete transformation, everything from your infrastructure, to thinking about how business models may change over the next 10 years, to the talent and culture, and operate in that regard,” he said.

The industry’s drive to enhance engagement with customers also will continue to be a much-discussed topic. Or as Honig puts it, the toothbrush versus the dentist visit argument. The toothbrush equals daily engagement. The dentist visit equates to a biannual event that is necessary but not always pleasant.

“I come down on the dentist visit,” he said. “I worry that trying to build a better toothbrush in insurance may be a fool’s errand.”

Honig is certain that people don’t want fitness tips or driving lessons from their insurers.

“I don’t want my insurance company telling me to slow down,” he said.

Other pertinent themes include artificial intelligence--Honig is quite bullish on it enhancing back office efficiency more than underwriting--blockchain technology and threats to the industry from tech giants such as Google and Amazon.

Although Honig had not yet decided if he would again address the audience from the InsureTech Connect stage, he was sure of one thing.

If he does, he will be wearing his signature fedora.

“When you’re as bald as I am, it’s kind of important,” Honig said. “It’s actually functional. It’s not just all style.”

ACORD Connect 2018

InsureTech Connect is not the only data-focused innovation trade show in the second half of 2018.

More than 400 attendees are expected Oct. 10-11 at ACORD Connect 2018 in New Orleans.

ACORD (Association for Cooperative Operations Research and Development) is an organization that develops industry standards for data acquisition and use among insurers and related companies.

ACORD Connect 2018 will focus on IT strategy, customer experience, emerging technology and data, analytics and business intelligence.

“We will continue to see the advancement of artificial intelligence and machine learning industry-wide over the next couple of years,” said ACORD’s Tanya Krochta, senior vice president and chief administrative officer, and Malou August, vice president, standards and membership. They responded to written questions. “The ability to leverage AI and machine learning will create more efficiencies for established insurance companies, while reducing costs dramatically, especially related to back-office services.”

One of the highlights of the event will be the presentation of the 2018 Global Insurance Marketplace Study, which will leverage 10 years of data across more than 8,500 insurers to examine the strategies needed to succeed in specific markets.

“The biggest challenge the insurance industry faces is one we have always faced, and that is adoption,” said Krochta and August. “There is so much more available to the industry to make our processes and business easier. We need to ensure that we are adopting technologies and standards that can communicate with each other so we can avoid back-office issues that would negate the advancements we are making.”

Take a look at Best's Calendar: Trade Shows/Conferences

Jeff Roberts is a senior associate editor. He can be reached at jeff.roberts@ambest.com.