Standing the Test of Time

Standing the Test of Time

A 120-year-old fire and casualty insurer joined the ranks of companies that have maintained a Best’s Financial Strength Rating of A or higher for at least 75 years.

After building successful insurance operations around the globe, Cornelius Vander Starr turned his attention to the American market. Starr, the founder of what is now American International Group, had laid the foundation for an empire by launching operations across Asia and in France, Italy, Germany and the United Kingdom. But he wanted to expand in the American market. In 1952, he acquired Globe and Rutgers Fire Insurance Co. and its subsidiary, American Home Fire Assurance Co., to broaden his domestic market presence.

American Home Assurance, the rebranded name of Globe and Rutgers, joined 66 other property/casualty companies that have stood the test of time by retaining an A or higher Best's Financial Strength Rating for at least 75 years.

Globe and Rutgers was created at the turn of the 20th century as a fire and casualty insurer. Over the years, the company grew its portfolio to also include business lines of insurance such as workers' compensation, wholesale umbrella and catastrophic risk. The company also underwrites policies for consumer electronics to be covered under manufacturer and retailer warranties.

In 2018, the New York City-based company, a subsidiary of AIG, had more than $24.7 billion in assets and $5 billion in earned premiums, according to AM Best.

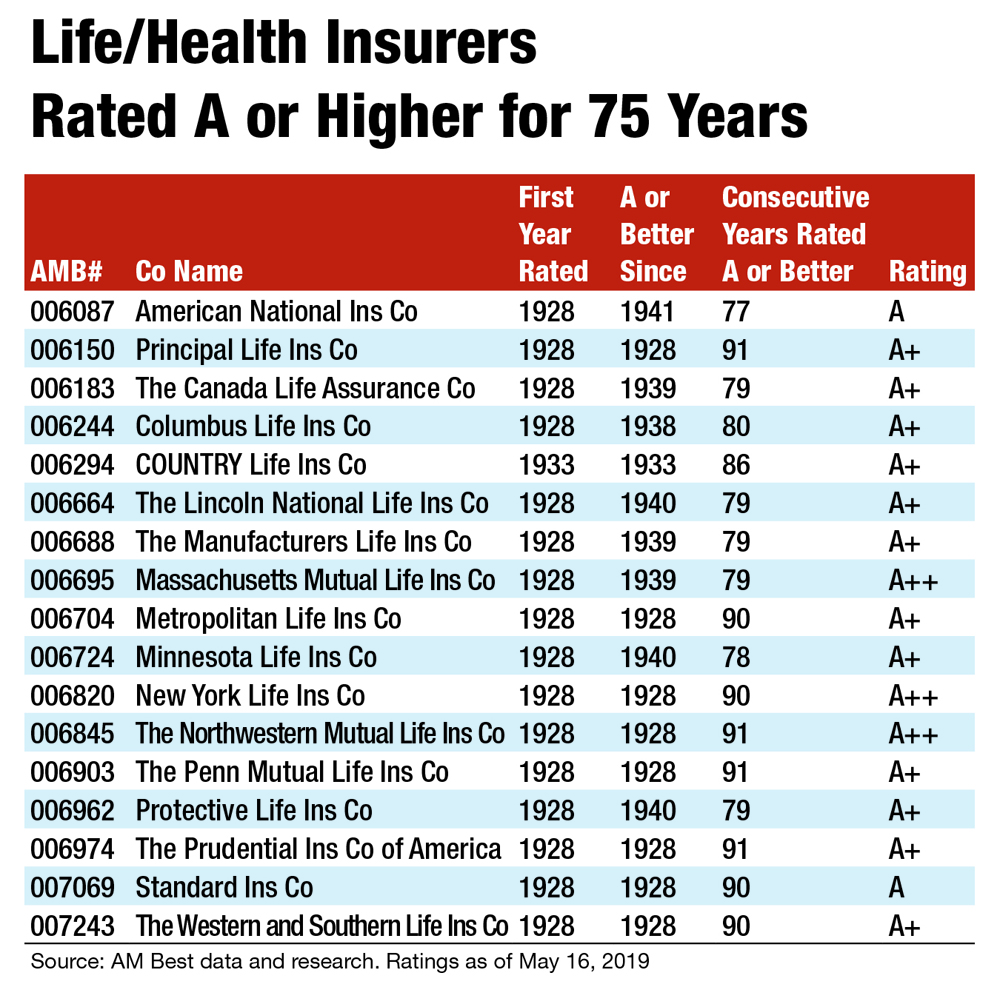

On the life/health side, 17 companies retained an A or higher Best's Financial Strength Rating for at least 75 years.

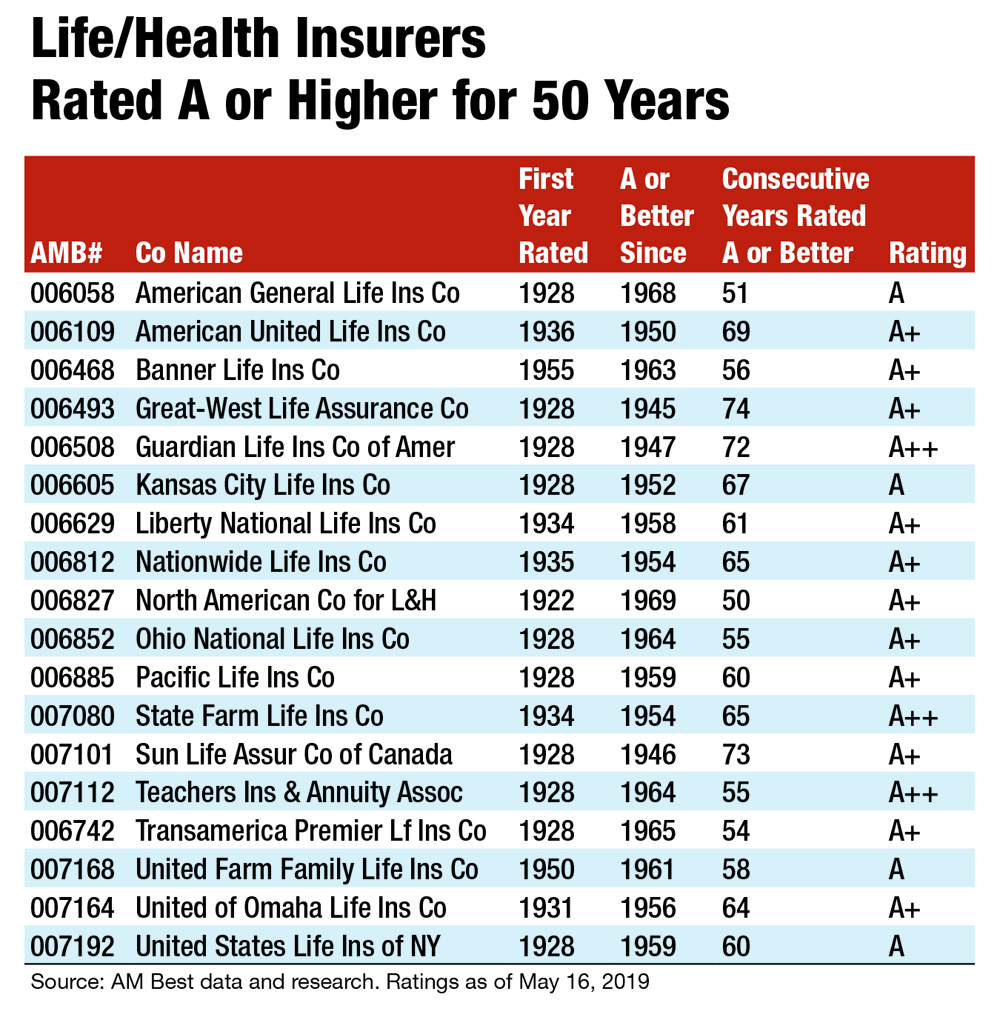

Another group of 18 life/health companies kept their A or higher rating intact for a half-century or more.

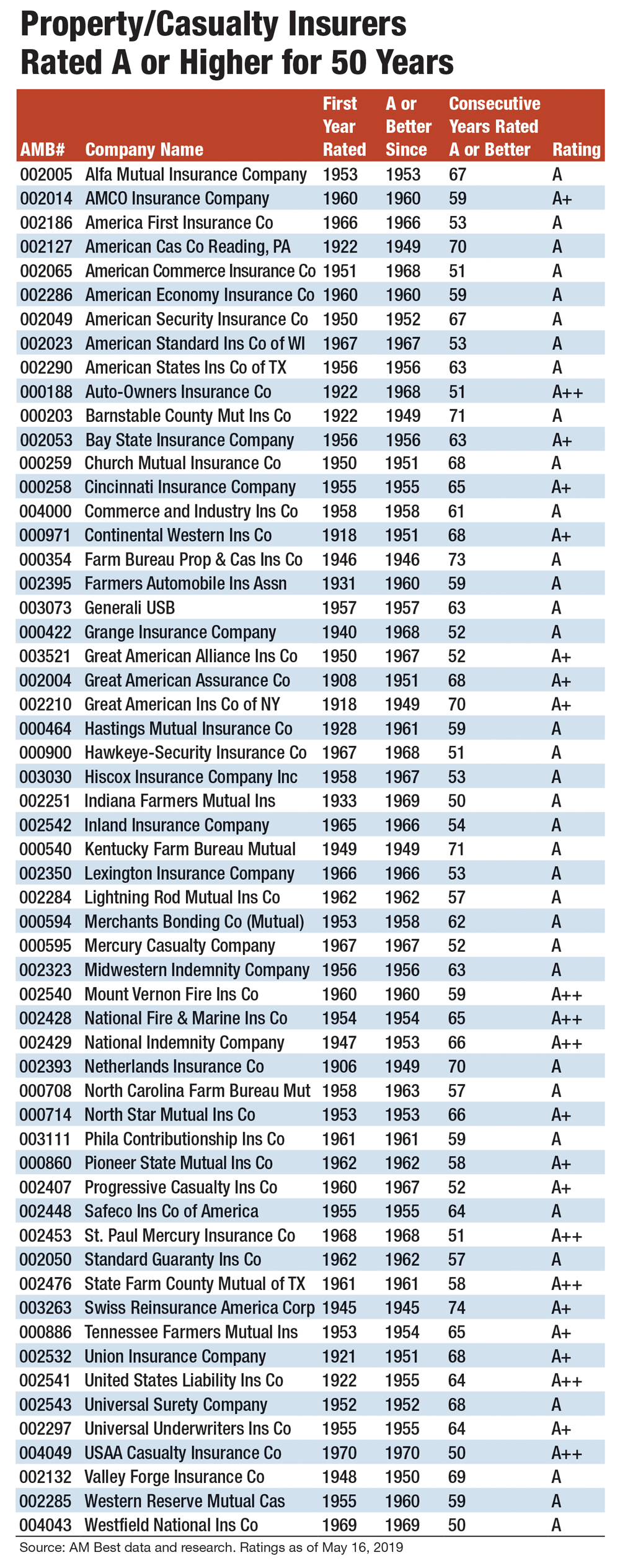

Fifty-seven property/casualty companies held that title in 2018.

Property/casualty insurers Federal Insurance Co., Hartford Fire Insurance Co. and New Hampshire Insurance Co. all have 112 consecutive years with an A or higher rating.

On the life/health side, Principal Life Insurance Co., The Northwestern Mutual Life Insurance Co., Penn Mutual Life Insurance Co. and Prudential Insurance Company of America maintained their A or higher rating from AM Best for 91 consecutive years.

Indiana Farmers Mutual Insurance, Westfield National Insurance and USAA Casualty Insurance were newcomers to the list of property/casualty companies with an A or higher rating for at least 50 years.

The oldest of the three is Indiana Farmers Mutual, founded in 1877 by the state grange under the Farmers Mutual Law of Indiana to provide insurance for farm properties. In 1968, the company restructured as a mutual insurer under the Indiana insurance code.

Over the years, Indiana Farmers Mutual acquired a handful of companies including Indiana Mutual Hail Insurance Co., Gibson Warrick and Vanderburgh County Farmers Mutual Insurance and the Farmers Mutual Fire Insurance Company of LaPorte, Indiana. Several small local farm mutuals also were merged into Indiana Farmers Mutual.

This year, Indiana Farmers Mutual announced plans to expand into Illinois, marking the company's first excursion beyond its home state.

Westfield National Insurance opened its doors in 1968 under the parent company Ohio Farmers Insurance Co., which was founded in 1848 by community-minded farmers to insure their farms. Today, Westfield National Insurance is a multiline provider of business property and liability, personal lines and agribusiness insurance, along with surety bonds. The parent company has more than $5.6 billion in consolidated assets, according to Westfield.

Also in 1968, USAA Casualty Insurance Co. was incorporated under the laws of Texas as United Services Casualty Insurance Co. It changed its name to USAA Casualty Insurance Co. on Dec. 2, 1970. The company is a subsidiary of United Services Automobile Association, which was founded in 1922 by 25 U.S. Army officers who joined together to insure one another.

In July 1990, USAA Casualty Insurance Co. merged with USAA Casualty Insurance Company of Florida and redomesticated from San Antonio to Tampa, Florida. At the turn of the 21st century, the company, which offers auto, home, boat and business insurance, returned to its Texas roots and reverted to its original name, USAA Casualty Insurance Co.

On the life/health side, North American Company for Life and Health Insurance joined the ranks of companies with an A or higher rating for 50 years or more.

The 133-year-old company, which at the time of its founding was known as North American Accident Association, began as a mutual assessment company. It later reincorporated as a stock company. In 1967, the company was renamed North American Company for Life and Health Insurance, a title it still holds today.

North American was a pioneer in offering disability insurance for women, issuing its first policy in 1918. In 1984, the company introduced its first universal life product and later expanded its offerings to include fixed annuities.

In 1996, Sammons Enterprises Inc. acquired the Illinois-based company. In 2007, North American Company for Life and Health was redomesticated to Iowa.

113-Year Tradition

For 113 years, AM Best has been issuing Financial Strength Ratings or opinions on the ability of individual insurers to pay claims on the coverage they have underwritten.

A select group of carriers has consistently maintained strong Financial Strength Ratings for the past 50 and 75 years.

To identify the companies with the longest record of consistent financial strength, Best's analysts pored over the rating agency's proprietary data—primarily Best's Key Rating Guides and Best's Insurance Reports—to accumulate and verify ratings and other pertinent data dating back to 1905.

AM Best's Rating Scale has changed over time in an ongoing effort to increasingly distinguish the relative financial strength of insurers and adapt to changes in the insurance industry.

Therefore, in certain circumstances it was necessary to translate or convert various older ratings to conform to the present rating scale. (Note that these translations do not represent any material change or re-evaluation of a company's rating; they are merely a conversion from one scale to another).

The original rating system, implemented in 1906, was devised by the company's founder, Alfred M. Best.

In 1921, a new rating scale, General Policyholder Ratings, replaced the previously used Desirability Ratings, which applied only to property/casualty insurers.

Desirability Ratings consisted of two components: a loss-paying record, ranked on an alpha scale with “A” being the best; and a rating of management quality on a numeric scale with “1” being the best.

An Evolving Process

The rating scale adopted in 1932 had two components: the New Resource Rating, the forerunner of today's Financial Size Category; and the General Policyholders Rating, which evolved into today's Financial Strength Ratings.

From 1935 to 1975, AM Best did not assign letter ratings to life/health companies. Instead they had “comments.”

In order to complete this rating history project, a translation was devised to convert these “comments” to equivalent letter ratings. For example, from 1935 to 1952, “More than Ample” was found to be equivalent to today's “A” rating.

Best's Ratings

The Rating History Project is based on Best's Financial Strength Ratings. A Best's Financial Strength Rating is an independent opinion of an insurer's financial strength and ability to meet its ongoing insurance policy and contract of obligations. The rating is based on a comprehensive quantitative and qualitative evaluation of a company's balance sheet strength, operating performance and business profile.

AM Best was founded in 1899 with the purpose of performing a constructive and objective role in the insurance industry toward the prevention and detection of insurer insolvency. This mission led to the development of Best's Ratings, which are now recognized worldwide as the benchmark of assessing insurers' financial strength. Best's Ratings' opinions reflect an in-depth understanding of business fundamentals garnered for more than 100 years of focusing solely on the insurance industry. This is one reason why insurance industry professionals have consistently ranked Best's Ratings No. 1 in confidence, usefulness and understanding.

A Best's Rating is an independent third-party evaluation that subjects all insurers to the same rigorous criteria, providing a valuable benchmark for comparing insurers, regardless of their country of domicile. Such a benchmark is increasingly important to an international market that looks for a strong indication of stability in the face of widespread deregulation, mergers, acquisitions and other dynamic factors.

Anniversary BestMark

AM Best has a program to recognize insurance companies that have maintained a Financial Strength Rating of A or higher for at least 25 years.

The Anniversary BestMark program consists of a special icon—distinct from the standard BestMark—that incorporates the company's name and acknowledges the year a company first achieved the Financial Strength Rating of A or higher. Print and internet-compatible versions of the icon will be supplied. Eligible companies can use this icon in a manner similar to the current BestMark—for example, on their websites, in print and online advertising, and on the cover of Best's Rating Report reprints.

Eligible companies may request an Anniversary BestMark via email to bestmarkinsurers@ambest.com or phone call to AM Best, 908-439-2200, ext. 5373.

YOUR COMPANY NAME HERE